If you are an owner of a certain property and you have rented it out to another person, for his or her personal or commercial use, then it is very important for you to keep a proper record of all the amounts that you receive in respect of the ‘rent’. You can prepare one yourself using the above guidelines or let an online service provider prepare a professional-looking receipt for you.In this article, we will look for rent receipt templates but before that, let’s know what is the actual purpose of such a receipt. Whether you're a landlord or a tenant, rent receipts are easy to create and fill out.

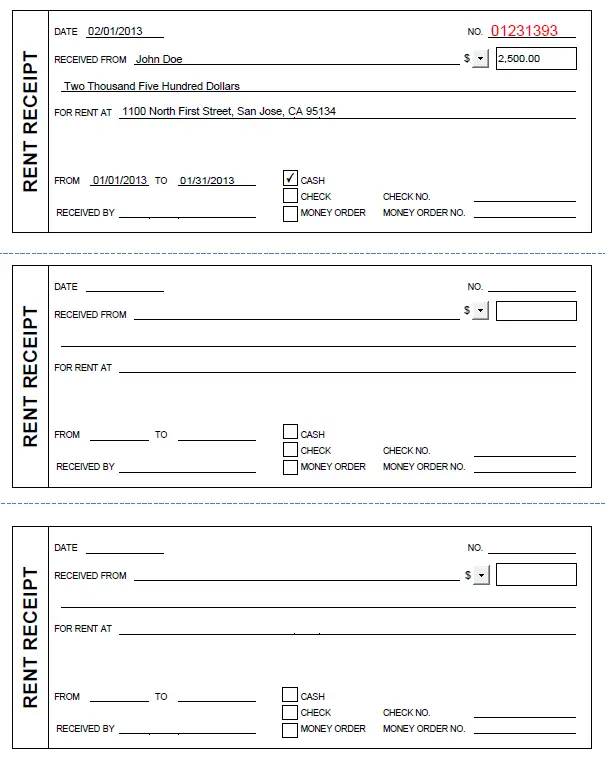

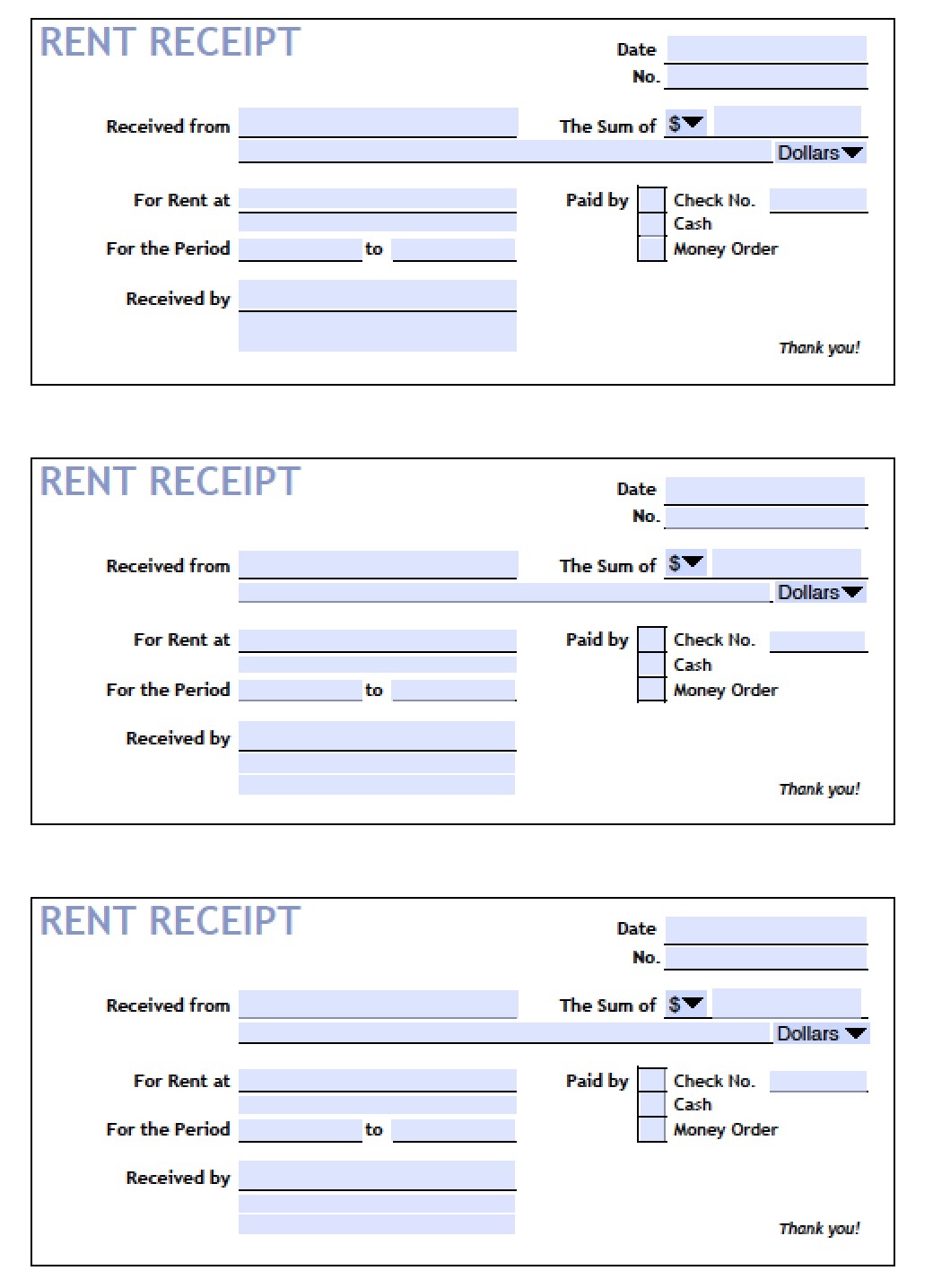

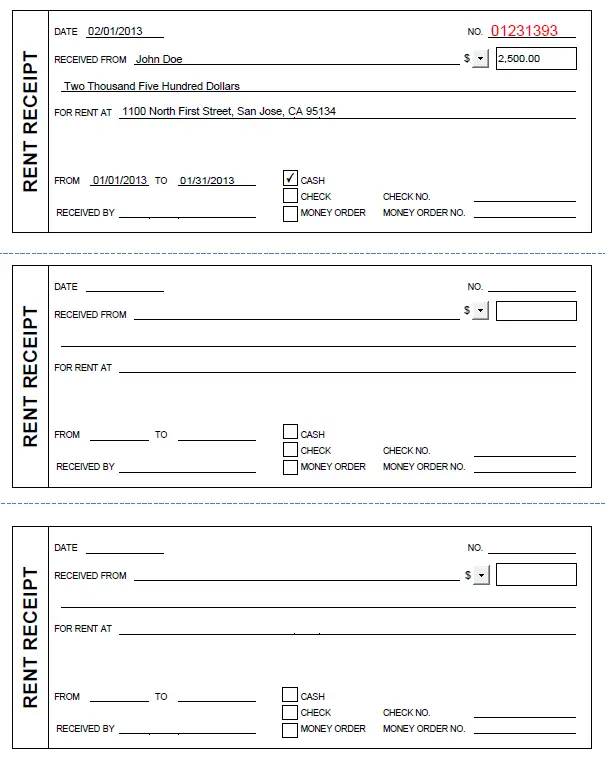

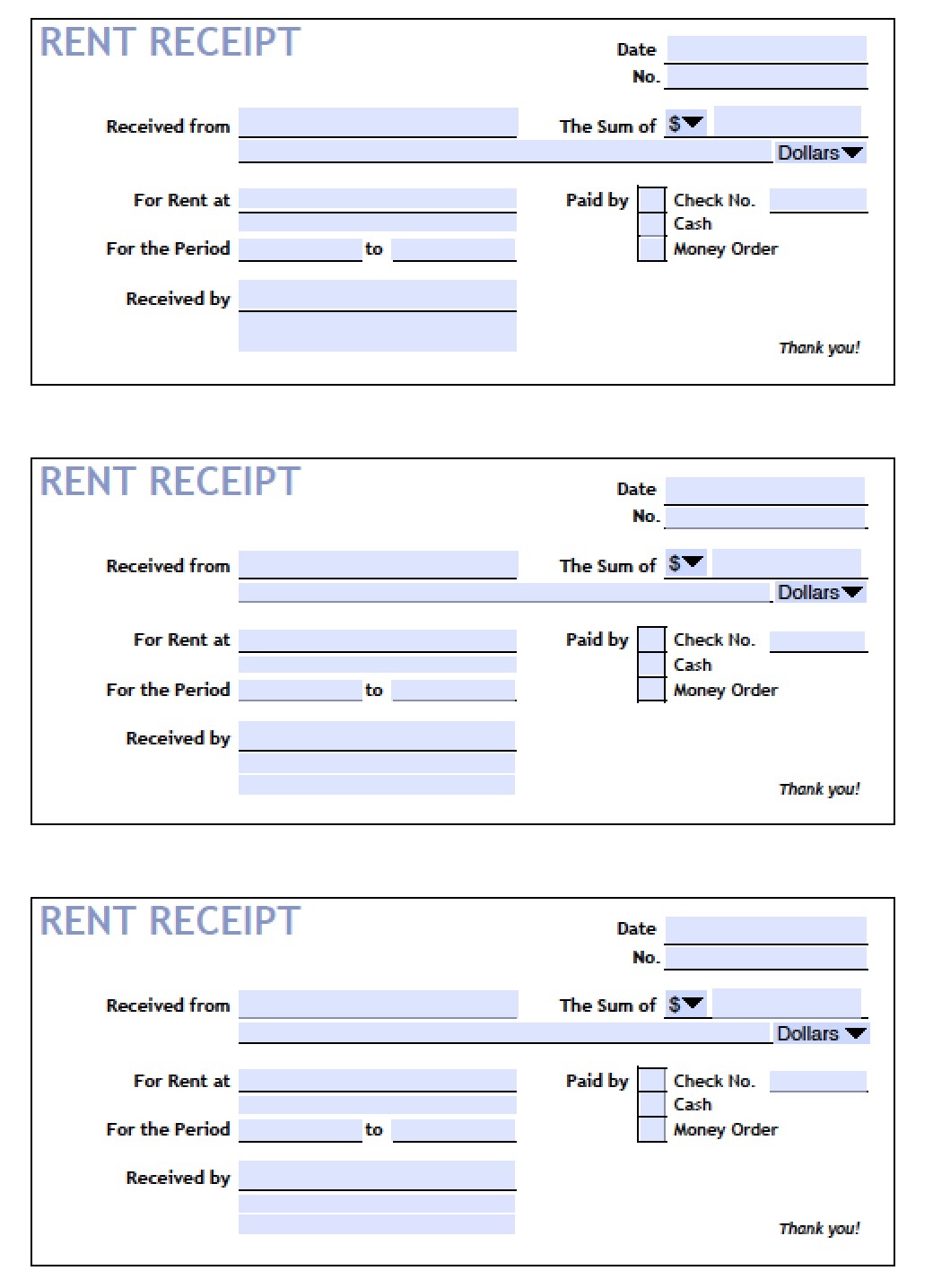

How the tenant paid the rent, such as in cash, by check, or by credit card. Which month the rent is for, including the first and last day the rent covers.  The landlord's acknowledgment that he received the tenant's payment. The tenant's name and rental address, with apartment number, if applicable. The landlord's or managing agent's name, address, and phone number. Whether you're the landlord or the tenant preparing a rent receipt for the landlord to sign, there is certain information a rent receipt should contain, including: To make the process easier, you can also use an online rental receipt form.Īs a tenant, you may also want a receipt if you work at home and want to claim a tax deduction for business use. Include the date, the amount paid, the rental address, what month the payment represents, your name, and unit. If the landlord won't provide one, you can prepare a receipt online and present it to the landlord for signature. If your state is one that allows a tax deduction for payment of rent, make sure you get a receipt every month. If you're the tenant, it's better to pay by check than by cash so you have an additional record of payment. Some cities require rent receipts even if the state doesn't, so check with your city's local housing board. Those states, and others require rent receipts upon the tenant's request, while others, including Massachusetts, require rent receipts in any situation. Washington, Maryland, and New York require rent receipts if the tenant pays in cash. Some states require landlords to provide tenants with rent receipts. Rent receipts also show when you paid the rent, which can protect you in the event the landlord wants to charge a late fee. Note that the the rent receipt does not show whether a rent check has cleared. Likewise, if a landlord sues you for nonpayment or takes you to court for eviction due to nonpayment, you can prove you're up to date by showing rent receipts to the judge. Should the landlord ever claim you haven't paid, you can produce a copy of your rent receipts.

The landlord's acknowledgment that he received the tenant's payment. The tenant's name and rental address, with apartment number, if applicable. The landlord's or managing agent's name, address, and phone number. Whether you're the landlord or the tenant preparing a rent receipt for the landlord to sign, there is certain information a rent receipt should contain, including: To make the process easier, you can also use an online rental receipt form.Īs a tenant, you may also want a receipt if you work at home and want to claim a tax deduction for business use. Include the date, the amount paid, the rental address, what month the payment represents, your name, and unit. If the landlord won't provide one, you can prepare a receipt online and present it to the landlord for signature. If your state is one that allows a tax deduction for payment of rent, make sure you get a receipt every month. If you're the tenant, it's better to pay by check than by cash so you have an additional record of payment. Some cities require rent receipts even if the state doesn't, so check with your city's local housing board. Those states, and others require rent receipts upon the tenant's request, while others, including Massachusetts, require rent receipts in any situation. Washington, Maryland, and New York require rent receipts if the tenant pays in cash. Some states require landlords to provide tenants with rent receipts. Rent receipts also show when you paid the rent, which can protect you in the event the landlord wants to charge a late fee. Note that the the rent receipt does not show whether a rent check has cleared. Likewise, if a landlord sues you for nonpayment or takes you to court for eviction due to nonpayment, you can prove you're up to date by showing rent receipts to the judge. Should the landlord ever claim you haven't paid, you can produce a copy of your rent receipts.

If you're a tenant, a landlord's rent receipt provides proof that you're current with your rent payments. If the check doesn't go through, the landlord can still, upon giving proper notice, go after the tenant for nonpayment of rent. Note, however, that a rent receipt of payment by check isn't proof that the check actually cleared. Rent receipts also help landlords keep track of which tenants have paid and which haven't.

RENT RECEIPTS PROFESSIONAL

There are several reasons landlords should provide rent receipts, including helping the landlord or management company maintain a professional appearance. Landlord Benefits of Providing Rent Receipts In addition to helping landlords keep meticulous records, these important documents provide tenants with proof that their rent has been paid.

If you're a landlord, some states may require you to provide rent receipts to your tenants.

0 kommentar(er)

0 kommentar(er)